Urban 3 was hired by The Nehemiah Company—a real estate development firm based in the Arlington/Dallas – Fort Worth Metroplex— to conduct a scenario analysis and time-series value per acre analysis focusing on two of their most recent major projects. Both the Arlington Commons (a multifamily apartment community) and Viridian (a 2,000 acre master planned community) developments are located between Dallas and Fort Worth, in north Arlington, TX.

Arlington Community multi-family apartments (right)

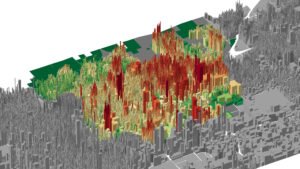

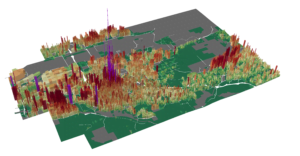

The objective of the analysis was to characterize and visualize the growth in real property value attributable to these two developments. Working with the Tarrant County Appraisal District, we retrieved property valuation data for six time points between 2006 and 2020, representing property values before, during and after development.

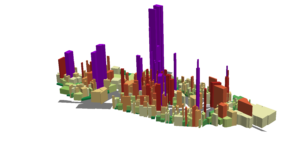

This analysis revealed that the taxable value of property associated with the first phase of the Arlington Commons multi-family development increased from roughly $1.7M before development to nearly $60.5 M upon completion in 2020— that’s a 35 fold increase in value.

The analysis also demonstrated that the value of property associated with the Viridian master planned community increased from $8.1M in 2006 to over $843.7 M in 2020— thats’ a 104 fold increase in value. Comparatively, the area surrounding both developments only doubled in value over the same time period.

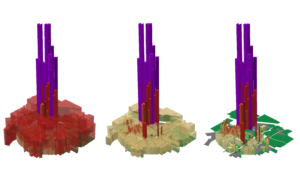

The master plan for the Viridian community includes a range of residential opportunities– including townhomes, apartments, zero lot line single family residential, and larger estate homes. In terms of public revenue productivity, the townhomes were among the most potent land uses in the area– valued at nearly $4.7 M per acre on average.

Outcomes

- Urban3’s work gave the developer a robust understanding of the economic impact of their developments on the local tax base and a tool to communicate these impacts with local decision makers, future clients, and the public.