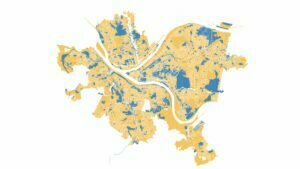

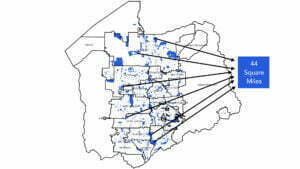

The public wealth of cities is a new idea championed by economist Dag Detter. Urban3 worked with Detter to create Public Asset Valuations for several cities and counties. These analyses create innovative ways of funding infrastructure and boosting local economic growth. By leveraging their existing holdings, public entities can utilize development to advance community fiscal sustainability and public policy goals.

Our work helps create the visual platform public entities can then use to determine how to manage public assets for the public good.

- Gain a holistic understanding of all publicly owned land

- Receive a model of projections on the potential value of all land, viewed as a real estate portfolio

- Visualize development scenarios for priority sites, based on comparable existing development

- Identify the net municipal revenue impact of potential private development

- Take steps to create a Public Wealth Fund to manage community real estate assets

“The Indicative valuations that Urban3 has done of U.S. cities show that public real estate in urban areas is substantial and reveal wealth, unknown to governments and stakeholders, that exceeds the annual economic output and represents half of the total market value of the city. In the case of Pittsburgh, the difference between book value and indicative value was 70 times. It proves that professionally managed, U.S. cities can generate more revenues from its assets than what it collects in taxes.”

— Dag Detter

Founder and Managing Partner, Detter & Co, and author of The Public Wealth of Nations